How to Reduce The Cost of Vacancy in Rental Properties

Vacancy is one of the most expensive challenges landlords face. Every month a unit sits empty means lost income, extra costs, and long-term impacts on property value. Understanding the true cost of vacancy in rental properties and learning how to minimize it is critical for profitability.

What Is Vacancy Loss in Rental Properties?

Vacancy loss is the rental income landlords miss out on when a unit sits unoccupied. If a property is listed at $1,800 per month and remains empty for two months, that’s $3,600 in lost rent. Add turnover costs like cleaning, repairs, and advertising, and the expense grows quickly.

Even a single month of vacancy can equal an 8–10% loss in annual rental income. That’s why experienced landlords often budget for at least one month of vacancy per year and take proactive steps to keep units filled.

The True Cost of a Vacant Rental Property

The cost of vacancy goes far beyond missed rent. It includes both direct and indirect expenses.

Direct Costs of Vacancy

- Lost rental income – the largest expense landlords face

- Utilities – electricity, water, gas, or internet needed for showings

- Maintenance and cleaning – turnover repairs, painting, deep cleaning

- Security costs – inspections to ensure the unit is safe

Indirect Costs of Vacancy

- Marketing and advertising – rental listings, professional photos, staging

- Property deterioration – unoccupied homes often need more upkeep

- Opportunity cost – lost chance to reinvest rental income elsewhere

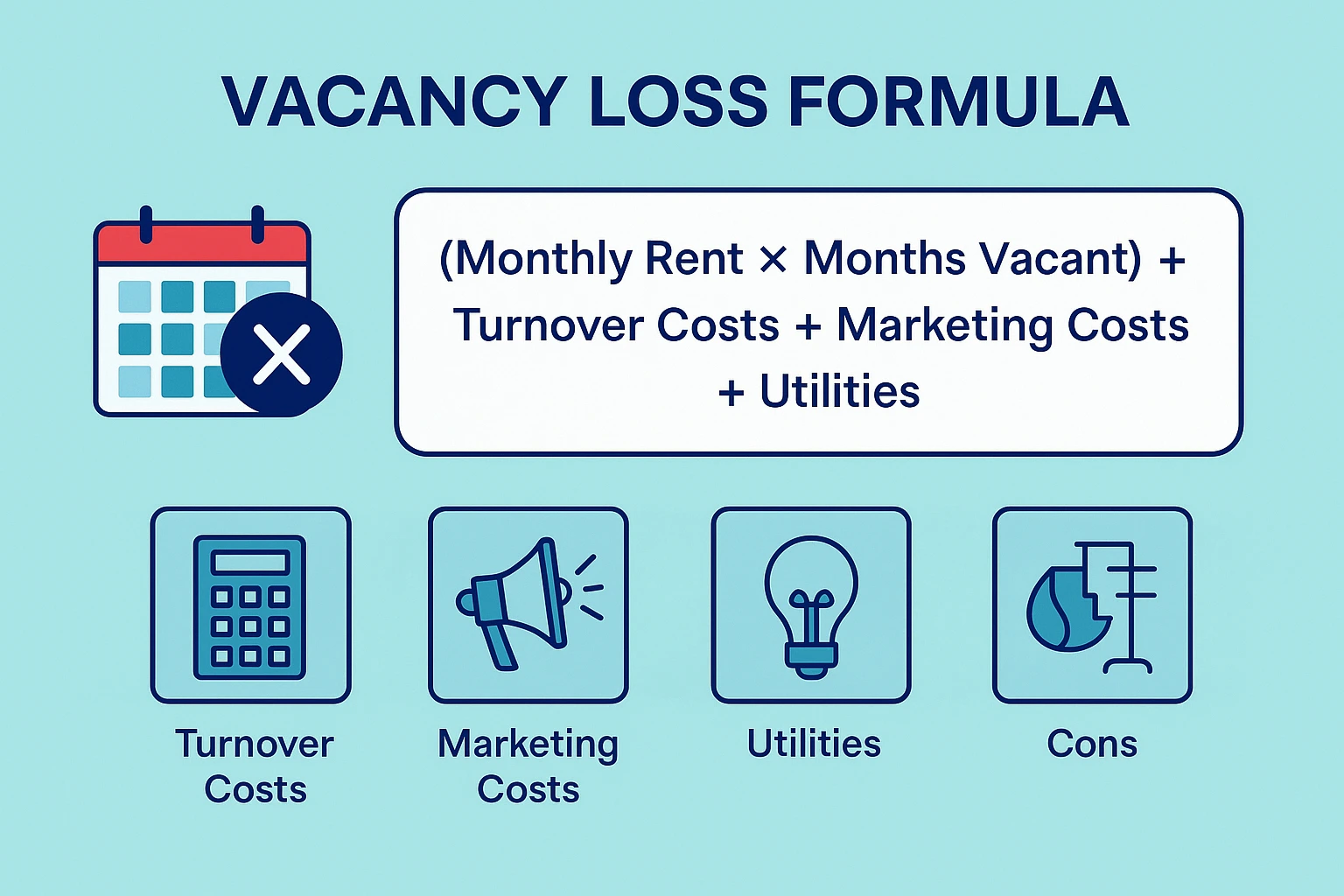

Vacancy Loss Formula for Landlords

Here’s a simple way to calculate vacancy loss:

Vacancy Loss Formula = (Monthly Rent × Months Vacant) + Turnover Costs + Marketing Costs + Utilities

Example:

Monthly rent: $1,500

Months vacant: 2

Lost rent: $3,000

Turnover costs: $500

Marketing: $200

Utilities: $100

Total Vacancy Loss = $3,800

That means two months of vacancy wipes out more than two months of profitability.

Free Vacancy Loss Calculator

Vacancy Rates and Property Value Impact

High vacancy rates don’t just hurt cash flow — they can also lower property value. Investors see frequent turnover as risky, which makes properties less attractive on the market. A property with a strong occupancy history usually sells for more than one with gaps in tenancy.

Factors That Influence Vacancy Rates

Several factors drive vacancy in rental properties:

- Uncompetitive rental pricing compared to similar units nearby

- Property condition – renters avoid poorly maintained homes

- Local job market and economy – fewer jobs means fewer renters

- Seasonal demand – summer typically sees higher demand than winter

How to Reduce Vacancy Rates

Some vacancy is inevitable, but landlords can minimize it with smart strategies:

- Set competitive rent using a rental market analysis

- Use professional photos and detailed online listings

- Respond quickly to tenant inquiries to reduce days on market

- Offer move-in specials or flexible lease terms

- Create a referral program where current tenants bring in new renters

Tenant Retention Strategies

The best way to reduce vacancy is to keep good tenants longer. Strong retention strategies include:

- Lease renewal incentives like small discounts or upgrades

- Routine property maintenance to show you care

- Fast responses to repair requests to build trust

- Building community with events or clear communication channels

Vacancy Cost Calculator

Here’s an example of how landlords can estimate the real cost of an empty unit:

Monthly rent: $1,500

Months vacant: 1

Turnover costs: $400

Marketing/showing: $150

Utilities: $100

Other costs: $0

Total Cost of Vacancy = $2,150

Even one month empty can cost more than just a month’s rent.

Using Technology to Minimize Vacancy

Modern property management tools help reduce vacancy by:

- Tracking lease renewals and automating reminders

- Offering online rent payments and maintenance requests

- Analyzing rental market trends for price adjustments

- Streamlining tenant communication

Final Thoughts

Vacancy loss is one of the largest and most underestimated expenses landlords face. By calculating the true cost of rental vacancy, monitoring market trends, improving tenant retention, and using proactive property management strategies, landlords can keep units full and protect long-term property value.

You’ve seen how expensive even a short vacancy can be. Allegiant Management Group helps landlords reduce turnover, fill units faster, and keep rental income steady. With proven local expertise and proactive management strategies, we make sure your property stays occupied and profitable. Schedule a Free Consultation with Allegiant Management Group.

FAQ: Vacancy Costs and Rental Properties

How much does a vacant rental property cost landlords?

Each month vacant typically equals 8–10% of annual rent lost. Add turnover and marketing costs, and the impact is even higher.

What is the average rental vacancy rate?

The national rental vacancy rate in the U.S. is about 7%, though local markets vary.

What are the best ways to reduce vacancy?

Price units competitively, improve tenant satisfaction, respond quickly to leads, and offer lease renewal incentives.

How do I calculate vacancy loss?

Multiply monthly rent by months vacant, then add turnover, marketing, and utility costs. Divide by annual potential rent to find the percentage impact.